6 Steps to Becoming a Millionaire by Saving

If you think you cannot become a millionaire by saving, think again! This may sound trivial, but you can become a millionaire by pure saving. So let’s try to find out more about 6 steps to becoming a millionaire by saving in this post.

“The habit of saving is itself an education; it fosters every virtue, teaches self-denial, cultivates the sense of order, trains to forethought, and so broadens the mind.”

– Thornton T. Munger

Contents

Related Posts

- 20 Secrets to Find Fulfillment in Life.

- 7 Reasons People Don’t Find Purpose in Life

- 5 Ways to Achieve Financial Independence

- How to Lead a Minimalist Life

- 10 Steps Towards Happiness

- 7 Ways to Declutter and Lead a Simple Life

Why Become a Millionaire

This might sound like an absurd question. But it is very pertinent. How? Unless we really want to become a millionaire, it is likely really difficult to become one. Because to become a millionaire, we need to sacrifice many things of instant gratification and live a disciplined life.

Then comes the million dollar question why we would want to become a millionaire? So the first thing that comes to our mind is that we want to splurge. For example, buy stuffs that gives instant gratification like buy a million dollar house. Or buy a sports car. Isn’t it?

Hence, let’s take a step back and really try to understand the question. Our instant gratification needs may be sporadic and temporal. So we may need to introspect what we really need from our lives? Then ask ourselves, what gives us true happiness and sustained satisfaction? Or what really gives us a sense of fulfillment in life?

What if we had all the time in the world to do what we truly enjoy? What if we don’t need to trade hours for money? So we can get out of the rat race to earn money for a living and truly start living. Which could help us find our purpose in life?

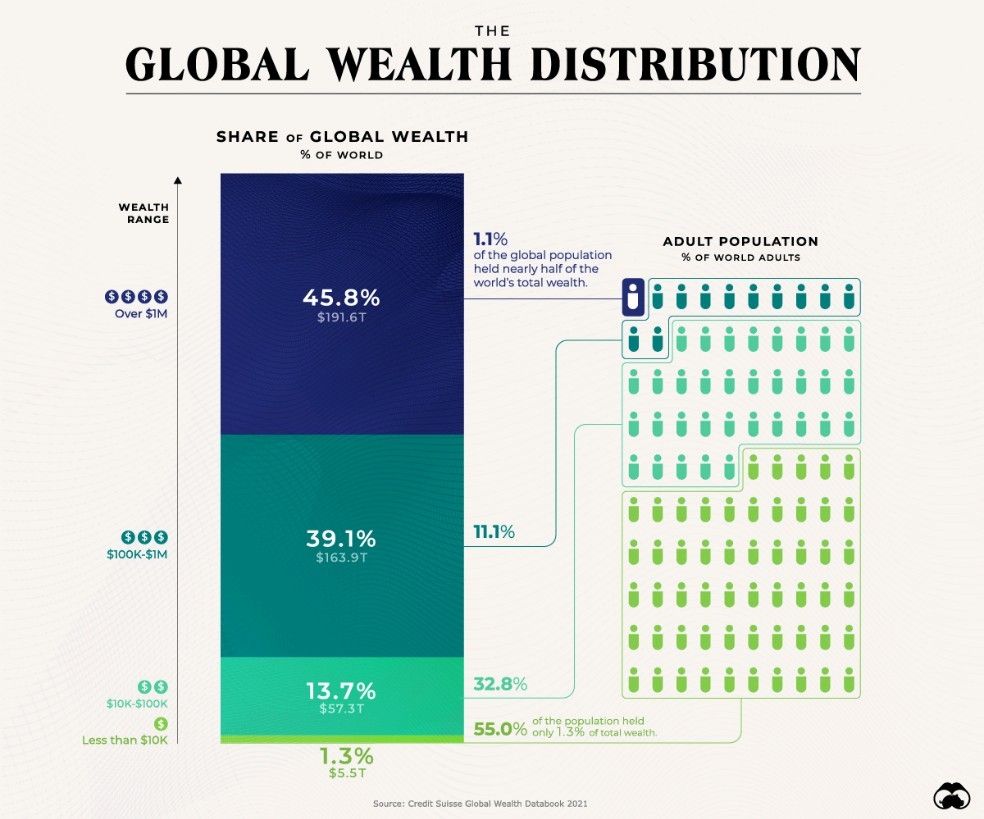

Becoming a millionaire is difficult. Only 1.1% of the population in the world are millionaires. Hence, the journey to becoming a millionaire is also difficult. With much ado, let’s learn about 6 steps to becoming a millionaire by saving.

6 Steps to Become a Millionaire by Saving

Saving is a discipline. Like exercising. It is a habit that we need to inculcate. Becoming a millionaire by saving is also not a sprint, it is more of a marathon.

Have a Budget

The first step to becoming a millionaire by saving is preparing a budget. By that, we also mean we create boundaries around our spending.

If we make $4,000 a month, let’s decide how much we can save from that. How much we really need to live a good and meaningful life? Of course, without splurging. Can we save 30% of that or stretch to 50%? What will we sacrifice by living within those boundaries? Is it worth making that sacrifice?

Save First

The second step to becoming a millionaire by saving is saving first. After you have a budget, now the first thing to do when you get your paycheck set money aside for saving.

This might not be easy. Since we will always have temptations to spend more than what we budgeted for in that month. Sounds familiar?

Save Regularly

The third step to becoming a millionaire by saving is to save regularly and consistently. So here comes the discipline part.

Just as “Rome wasn’t built in day” so becoming a millionaire also takes a lot of sacrifice and discipline.

It is difficult to take out a significant chunk of your pay every period and save or invest. Many times the question comes we earn to live a life, correct?

We earn to live a good life, but to live a good life we need to save for exigencies in life and to create the wealth we yearn for. And to come financially independent.

Invest Wisely

The fourth step to becoming a millionaire by saving is to invest wisely. The first and only rule for investing in never lose money. It is a profound rule. Any many times we don’t get it.

It is important to diversify our investments. So one way is to invest in low expense ratio index funds which could be pure equity or debt, or a balanced, likely a blend of equity and debt based on your financial goals. And try to with adequately diversify with other asset classes like real estate. The disclaimer here is I am not a certified financial advisor, so consult a financial advisor to invest wisely.

Again the golden rule for investment is never lose money.

Embrace Minimalism

The fifth step to becoming a millionaire by saving is to embrace minimalism. Minimalism is a way of life where we buy and keep what we really need in our lives. As the term suggest it means they are just the minimum things that we really need to live a meaningful life.

When we live a minimalist life, we live a simple life. And this simple living is an immense a source of happiness and stress reliever. We can then focus on trying to live a more meaningful life and try to find our calling and do what we really enjoy doing.

Live Frugally

The last and the sixth step to becoming a millionaire by saving is to live frugally. How is frugality different from minimalism? Frugality is to find the best value in thing we buy in terms of value for money and minimalism is all about trying to understand what we really need in our lives to live a fulfilling life and living with those bare minimum things.

The secret to saving is to find the maximum value for our money we spend. With more value we get from the products and services we buy, the more we can save.

How to Stay a Millionaire

Finally, once we become a millionaire, we need to stay a millionaire. It doesn’t take much to become a pauper from a millionaire. Staying a millionaire would need the same steps to become a millionaire.

If we go by the 4% financial independence rule, once you have $1M corpus and you have invested it, you could take out 4% out from the fund per year without reducing your principal amount. This assumes the corpus at a minimum grows by 4% annually. If you see the equity and debt funds returns over the 20 years in the United States, they have given 8.5% and 4.2% respectively. Hence, it is not unrealistic to expect a return of anywhere between 4-8% on your investments if invested wisely and regularly.

A 4% of $1M is annually $40,000 or about $3,300 a month which is pretty reasonable income to live a simple and meaningful life.

Conclusion

In summary, the 6 steps to becoming a millionaire by saving pivots around having a budget, prioritizing saving regularly, investing wisely, and living a minimalist and frugal life.

It is on us to whether we want to become and stay a millionaire pretty much. Of course, it is a journey, and it is difficult. But it is pretty much achievable. It needs a disciplined approach to saving and investing.

With saving, it also needs maintaining and maximizing your income. That is a topic of another post(s).

Please let me know your thoughts in the comments section. Happy living.

Leave a Reply

You must be logged in to post a comment.