Why Frugality Makes Sense?

Did you know why frugality makes sense? How frugality can help us find our purpose in life? And improve our quality of life? In this post, I will share why frugality makes sense?

“Frugality is one of the most beautiful and joyful words in the English language, and yet one that we are culturally cut off from understanding and enjoying. The consumption society has made us feel that happiness lies in having things, and has failed to teach us the happiness of not having things.”

– Elise Boulding

Contents

Why Frugality Makes Sense?

Generate Wealth

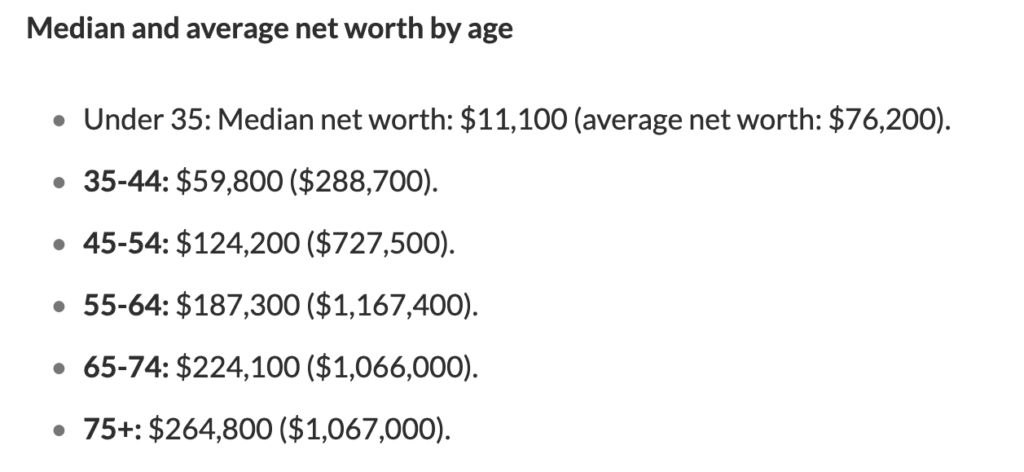

Is being rich the same as being wealthy? If one has a very expensive car and large house but has a negative net worth, is that person considered wealthy? Well, we measure wealth by net worth. If one’s assets are greater than one’s liabilities, the person is net worth is positive. A person can be rich, but if his or her net worth is negative, that person is not wealthy. According to an article by Dayana Yochim from NerdWallet in Market Watch on January 23, 2020, the median net worth of Americans is $97,300. The Federal Reserve’s Survey of Consumer Finances published this data in 2016. The average net worth of Americans is $692,100, but the nation’s super-wealthy skew this data.

This is how the median net worth looks by age for Americans.

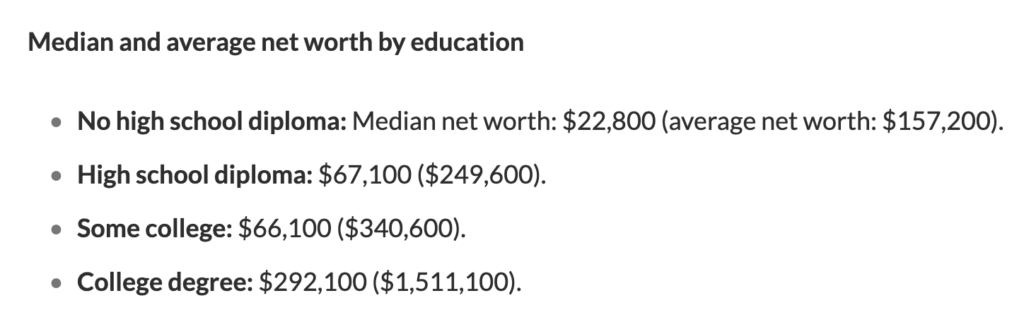

And this how the median net worth looks by education for Americans.

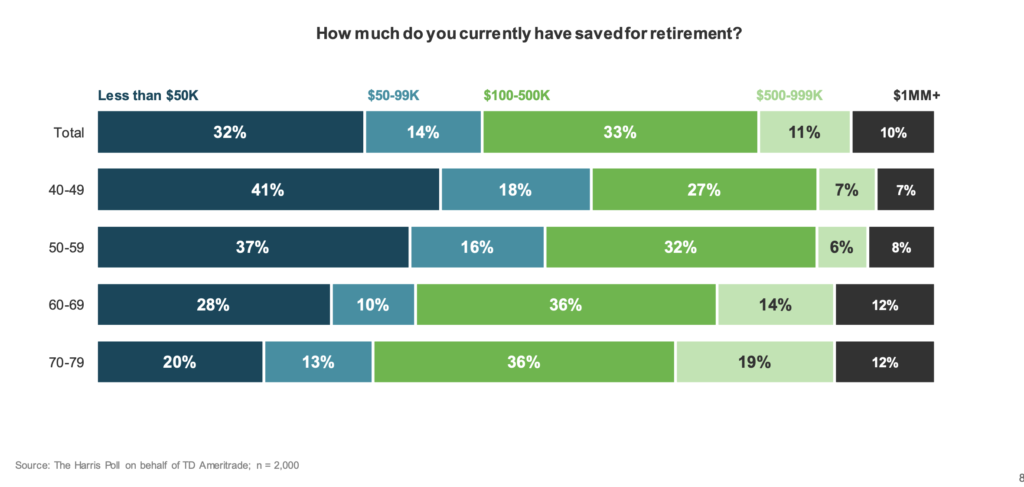

Helps Save Money

Is the net worth of $187,300 to $224,100 at around 65 years adequate in the US? According to an article by Kathleen Elkins from CNBC on January 23, 2020, reviewing a 2020 TD Ameritrade report states “The report, which surveyed 2,000 U.S. adults ages 40-79 with at least $25,000 in investable assets, finds many Americans may have a way to go, even those approaching their golden years. Nearly two-thirds of 40-something have less than $100,000 in retirement savings and 28% of those in their sixties have less than $50,000.”

So how much do you need to save for retirement in the US? You may use a retirement calculator to estimate.

To enjoy retirement, aggressive saving is essential for building a sufficient nest egg. Life is about choices. The choices we make today determine how we live tomorrow.

Give Back

According to the article by John Holmes from the United Nations, “Each day, 25,000 people, including over 10,000 children, die from hunger and related causes.”

Does it still make sense to splurge, even if we are wealthy? Can living frugally not only save enough for ourselves but also give to the less fortunate? Could we be happier if we live frugally? Can giving back to the less fortunate make us happier?

Conclusion

So does living frugally make sense? After all, we earn to live well, correct? But does that mean we splurge and don’t save enough for tomorrow? Or not save enough to face the uncertainties of tomorrow?

Frugal living in a course of time increases our wealth if we can control our spending to stay lower than our income. And increasing our wealth to achieve our retirement savings early enough helps us achieve financial independence and security. This subsequently helps us explore our purpose in life and the realization of one’s fullest potential through self-actualization in Maslow’s hierarchy of needs.

Leave a Reply

You must be logged in to post a comment.