How I Achieved a Million Dollar Net-Worth

Before I dive into the post talking about how I achieved a million dollar net-worth, I would like to jump into why I am writing a post on this topic? Is our financial matters not personal and we shouldn’t share it in public? I believe it is true. But the purpose of this post is more to share how I achieved a net-worth of a dollar millionaire. To assure that you can also achieve it. For most of us, it needs some lifestyle changes. Some extra efforts. Sacrifices. And willing to take some calculated risks. I live frugally and am an ardent minimalist. The point I am trying to make is that it is very much possible to become an everyday millionaire with no frills attached. Makes sense? So let’s begin.

Money is not everything. Make sure you earn a lot before speaking such nonsense.

― Warren Buffett

Contents

- 1 Related Posts on How I Achieved a Million Dollar Net-Worth

- 2 What is Net-Worth?

- 3 Global Distribution of Dollar Millionaires

- 4 Why You Need to Have a Million Dollar Net-Worth?

- 5 How I Achieved a Million Dollar Plus Net-Worth

- 6 How You Can Achieve a Million Dollar Net-Worth

- 7 Conclusion on How I Achieved a Million Dollar Net-Worth

Related Posts on How I Achieved a Million Dollar Net-Worth

- 6 Steps to Becoming a Millionaire by Saving

- 5 Ways to Achieve Financial Independence

- How to Lead a Minimalist Life

- Is Minimalism a Solution for Sustainability?

- Why Frugality Makes Sense?

- 7 Ways to Declutter and Lead a Simple Life

- How Much Money You Need to Live a Fulfilled Life?

- 10 Steps Towards Happiness

What is Net-Worth?

Net-worth simply means your assets minus your liabilities. Say the total worth that you own, including financial products like investments/ savings and physical assets like house, cars etc minus your debt like mortgages. So say if your total assets are worth $700,000 and you have a debt of $300,000, then your net worth is $400,000.

So let’s dive into the distribution of dollar millionaires in the world.

Global Distribution of Dollar Millionaires

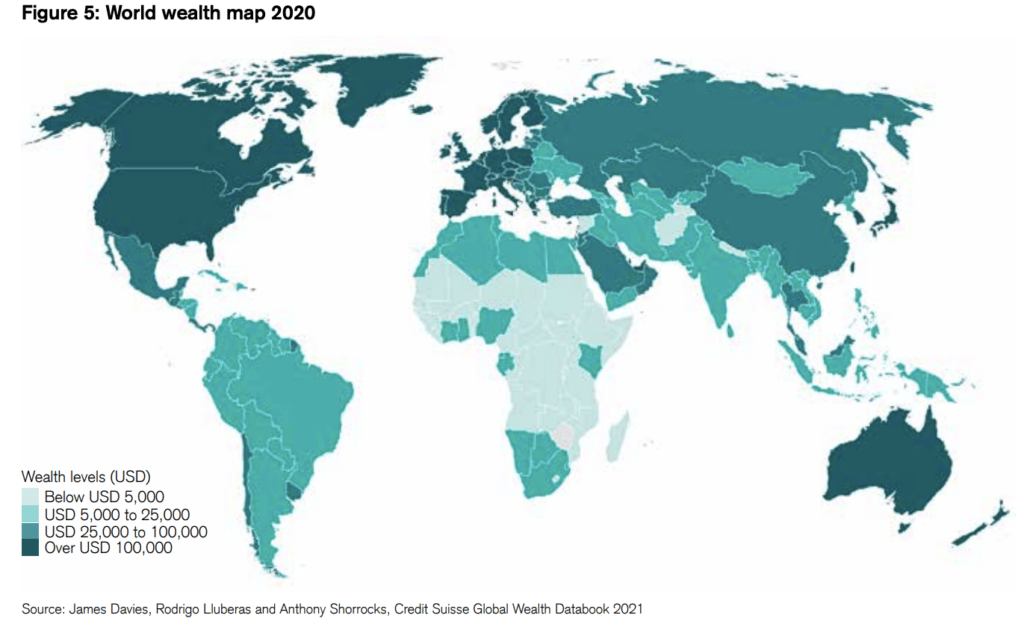

World Wealth Map 2020

The below is data is from the Credit Suisse global wealth report of 2021. It shows the average wealth (net worth) per adult country wise in 2020.

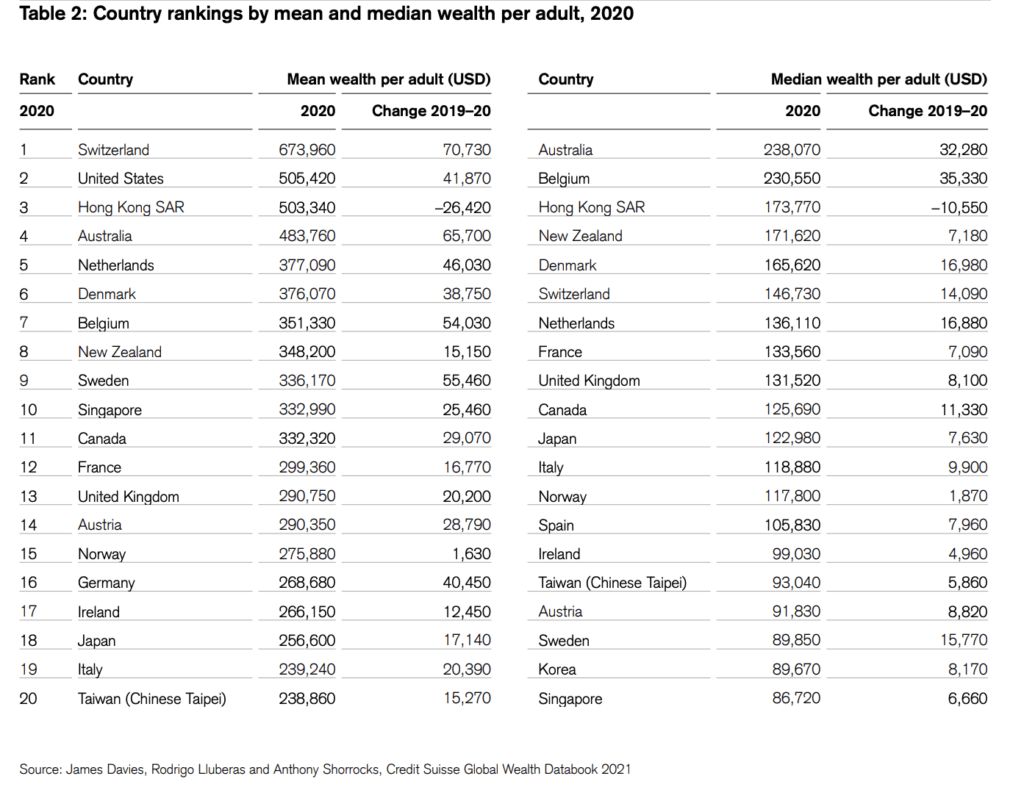

And the chart below shows the raw data behind the chart above, illustrating both the average and median wealth per adult country-wise. So one thing to observe, which should not be a surprise.

If you note the average wealth (net worth) of Americans, it is $505,420, but the median of the United States does not even show up the top 20 countries list (less than Singapore’s $86,720). Why is that so? This points to economic inequality, which is going the topic for another post.

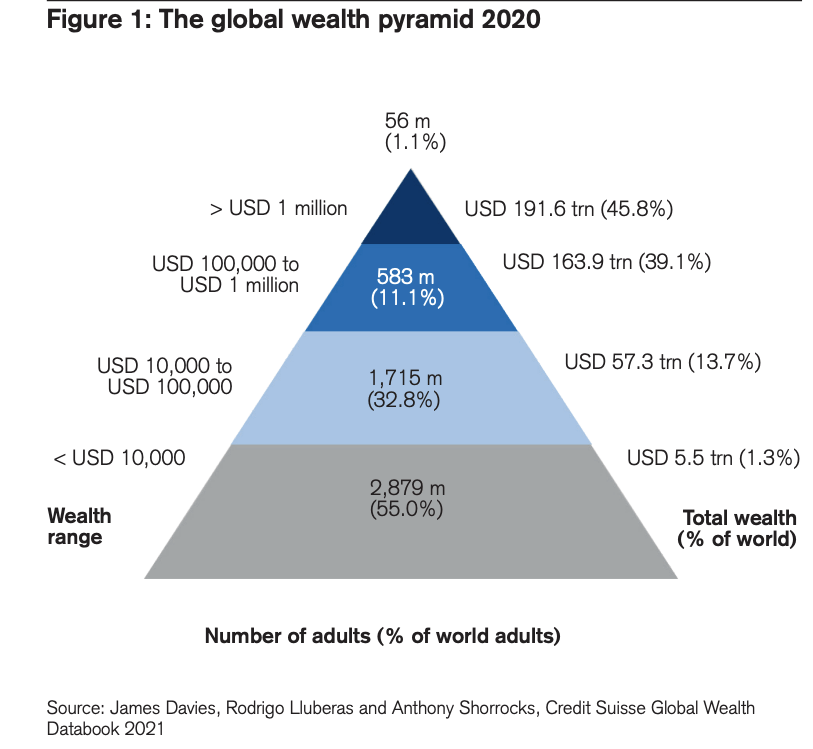

Now let’s try to get a global picture of several millionaires in the entire world. The below chart depicts the global wealth pyramid for 2020. It’s a busy chart but the key takeaway is that globally there are 56 million adult dollar millionaires in the entire world, which is 1.1% of the global adult population.

Number of Dollar Millionaires 2020

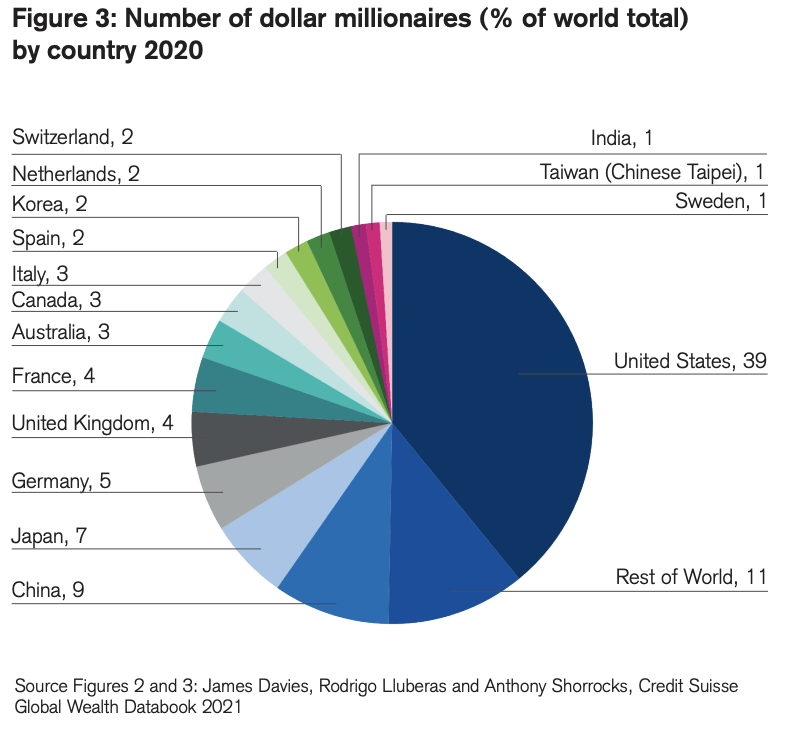

Then what is the distribution of the dollar millionaires globally? Is it surprising that the United States has the highest number of dollar millionaires at 39% followed by China at 9% and then Japan at 7%?

The chart below shows the adult millionaires country-wise for 2020 and also how it changed from 2019. The adult population of the US in 2020 was 258.3 million based on data from United States Census Bureau. With the adult millionaires in the United States being 21.9M in 2020, this leads to approximately 8.5% adults in the United States are dollar millionaires. Does this figure surprise you?

Why You Need to Have a Million Dollar Net-Worth?

Now that we have got a fair understanding of the global dollar millionaire distribution, let’s dive into my theory of why you need to be one. Sounds interesting? It is difficult, but a goal worth striving for.

How I Achieved a Million Dollar Plus Net-Worth

What is My Net-Worth?

I was doing a quick math using a net-worth calculator recently from Nerdwallet and estimated my net worth as on a date about $1.3M USD so that brings me within the top 10% percentile in the US from a net-worth perspective.

The way I see myself is that I am an everyday millionaire, meaning you can find folks like me around you and not even guess they could be a millionaire. I live a very frugal and minimalistic life in the US, live in a rented apartment and have zero debt. That will be another topic of a post though since with record low housing mortgage loans does it not make sense to be a homeowner? I own some real estate in India, though, which includes my earlier residential apartment when I lived in India before immigrating to the US.

Then also, what is my life’s goal in terms of net-worth? I would put that number to be about $5M and that should bring be within the top 5% percentile in the US. Do you think we should have net-worth goals to achieve in our lifetimes? I believe we should always have a goal and then have a plan to achieve it. It might not sound easy, but it might be worth considering having a goal and a plan than not having one.

How I Made it- Million Dollar Net-Worth

So the question you may have is, how did I become a dollar millionaire? Let me try to explain it in 5 steps.

Save Save Save

This is not rocket science :-). To become a millionaire, you need to save first and then spend what is remaining. Save until it hurts. I have been saving most of my income on a monthly basis. Many times even up to 80%. It is difficult for sure. Needs a lot of discipline and sacrifice.

But isn’t life about living our life? Then why should we live frugally if we have money to spend? Interesting topic for discussion!. It also depends on what gives you true happiness. Do you get a lot a sustained happiness when you buy a lot of stuffs? I used the word “sustained” because many times we get a lot of hedonistic pleasure when we buy expensive material things like cars, boats and house. But is that happiness “sustained”? Can you get happiness from living a simple and minimalistic life? Think about it because I derive a lot of happiness and inner peace by living a simple life.

Invest Your Savings

Once we save, then the next step is to make sure we can grow our money. And leverage the power of compounding. So, depending on your risk appetite, you need to invest your money wisely. But most of the time, it is pretty simple. Best is to invest in the lowest possible expense ratio index funds. In the right blend between equity and debt index funds. That is going to be a topic for another post on the specifics and funds I invest in.

Maximize on Tax Benefits

Then we should not underestimate the importance of tax benefits for our savings. How we need to maximize our savings first into tax sheltered accounts. Like employer provided 401 (k), IRA ROTH and IRA Traditional, HSA and children education 529 accounts. Also, real estate investing provides significant tax benefits, especially in the US you can claim depreciation and expenses as deductions. In countries like India, there are tax benefits for both principal and interests as deductions. After we maximize the yearly contributions in these tax sheltered accounts, then we can invest in taxable accounts like individual brokerage accounts. For sure, topics for separate posts.

Invest in Yourself

When I say invest in yourself, I mean develop your skills or learn new skills that will enhance your market worth. Sounds complicated? Well, if you are an employee, you are in the job market and you need to up-skill continuously so that you can add move value to the company you work for. In return, you increase your worth in your company, which may have a positive impact on your remuneration. Many times, even if you don’t see any positive impact of remuneration in the short term, it is still okay. Because your increased skill and knowledge will just help you do your work better and you will be more confidence. This in the longer time will help for sure. Trust me.

Be a Lifelong Learner

Last but not the least, is always to be and stay a lifelong learner. There is always something to learn that can not only up-skill ourselves but also learn something that helps us how to save our hard earned money in the most beneficial way. That can help us increase our net-worth.

How You Can Achieve a Million Dollar Net-Worth

You can also strive to become a dollar millionaire if you are not already. Or strive to increase your net worth. Again, can’t overemphasize on first have a goal and then have a plan. The reason I wrote this post about how I achieved a million dollar net-worth, is that you get can some cues from personal experiences. I plan to write some detailed posts on each of the investment options, their pros and cons with risks.

Conclusion on How I Achieved a Million Dollar Net-Worth

To conclude how I achieved a million dollar net-worth, is more to share my experience with you on the journey to become a millionaire. In a nutshell, the key is to save more and more. Then invest wisely. Should maximize on tax benefits. All along, invest in yourself to improve your capabilities, skills, and knowledge. And be a lifelong learner.

Please let me know what you think about this post and if it was of any help. There is a lot I tried to cover in this post. So please let me know if you’d like to read more about any specific topic in this post.

Leave a Reply

You must be logged in to post a comment.